Why Is the Crypto Market Up Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) registered a staggering rally over the last 24 hours as US President Donald Trump announced a new crypto reserve for the country. This resulted in altcoins observing sharp upticks led by Cardano (ADA) with a 61% rise.

In the news today:-

- US authorities are working to return $8.2 million in seized crypto to victims of a scam involving fraudulent messages and a fake investment scheme. The FBI identified 33 victims, with total losses amounting to $6 million, while five additional victims are yet to be identified.

- US President Donald Trump has unveiled plans for a US Crypto Strategic Reserve, aiming to include XRP, Solana (SOL), and Cardano (ADA). In an announcement, Trump confirmed that he had signed an executive order directing the Digital Assets Working Group to move forward with establishing the reserve.

The Crypto Market Recovers

The total crypto market cap has surged by $237 billion, reaching $3.03 trillion at the time of writing. This uptrend signals growing investor confidence, with the next major resistance levels at $3.09 trillion and $3.16 trillion.

Market sentiment remains optimistic following the announcement of the US Crypto Strategic Reserve, which could act as a catalyst for continued growth. If TOTAL surpasses $3.16 trillion and establishes it as support, this would reinforce the bullish structure.

Despite recent gains, the crypto market is still vulnerable. TOTAL has declined by $68 billion today, indicating potential selling pressure. A drop below $3.00 trillion could trigger further corrections, potentially reversing bullish momentum.

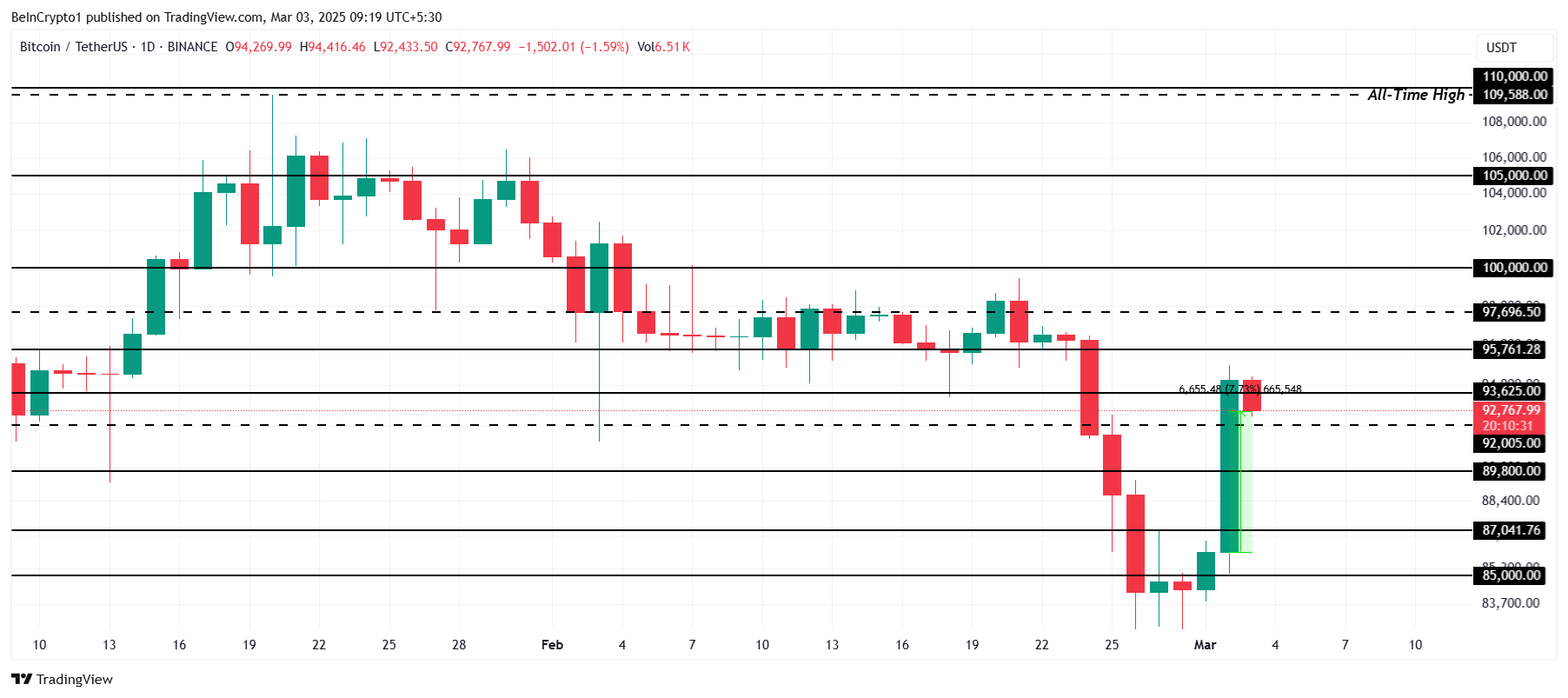

Bitcoin Is Back Above $90,000

Bitcoin is up 7.7%, trading at $92,767 while holding above the $92,005 support level. Earlier, BTC briefly touched $95,000, signaling strong buyer demand. This surge reflects renewed market confidence, with bulls defending key price levels. Maintaining momentum above $92,005 is crucial to sustaining the ongoing uptrend.

The recovery has fueled optimism for further gains. Breaking past the $95,761 resistance could push BTC toward $97,696, reinforcing bullish sentiment. If Bitcoin establishes $95,761 as support, it could attract more buying pressure.

However, profit-taking remains a risk. If BTC holders sell aggressively, a dip below $92,005 could trigger a decline toward $89,800. Selling pressure at current levels may disrupt the rally, potentially leading to further corrections.

Cardano Skyrockets To $1

Cardano surged 61% in 24 hours, now trading at $1.06. This marks its first return above $1 in a month. Renewed investor interest has strengthened ADA’s position, reinforcing bullish sentiment. Holding above this level is critical for sustaining upward momentum and avoiding a potential reversal in the market direction.

The inclusion of ADA in the US Crypto Strategic Reserve triggered the rally, pushing it toward the $1.13 resistance. If buying pressure continues, a breakout above this level could accelerate gains. Establishing $1.13 as support may fuel further growth, draw more investors, and strengthen its position in the altcoin market.

However, downside risks remain. Losing support at $1.01 could lead to a decline toward $0.85, erasing recent gains. A drop below this key level would shift sentiment to bearish, potentially invalidating the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Post Comment